Our path to world-class payments: reflections on The Point 2024

Steve Wiggins, Chief Executive, Payments NZ

It’s hard to believe it’s been almost three weeks since we were all together at The Point 2024. I’m still getting messages and emails and seeing responses online with fantastic feedback on our conference. The direct feedback from delegates has been overwhelmingly positive and tells me that we hit the mark this year in bringing our industry together and tackling big issues in payments.

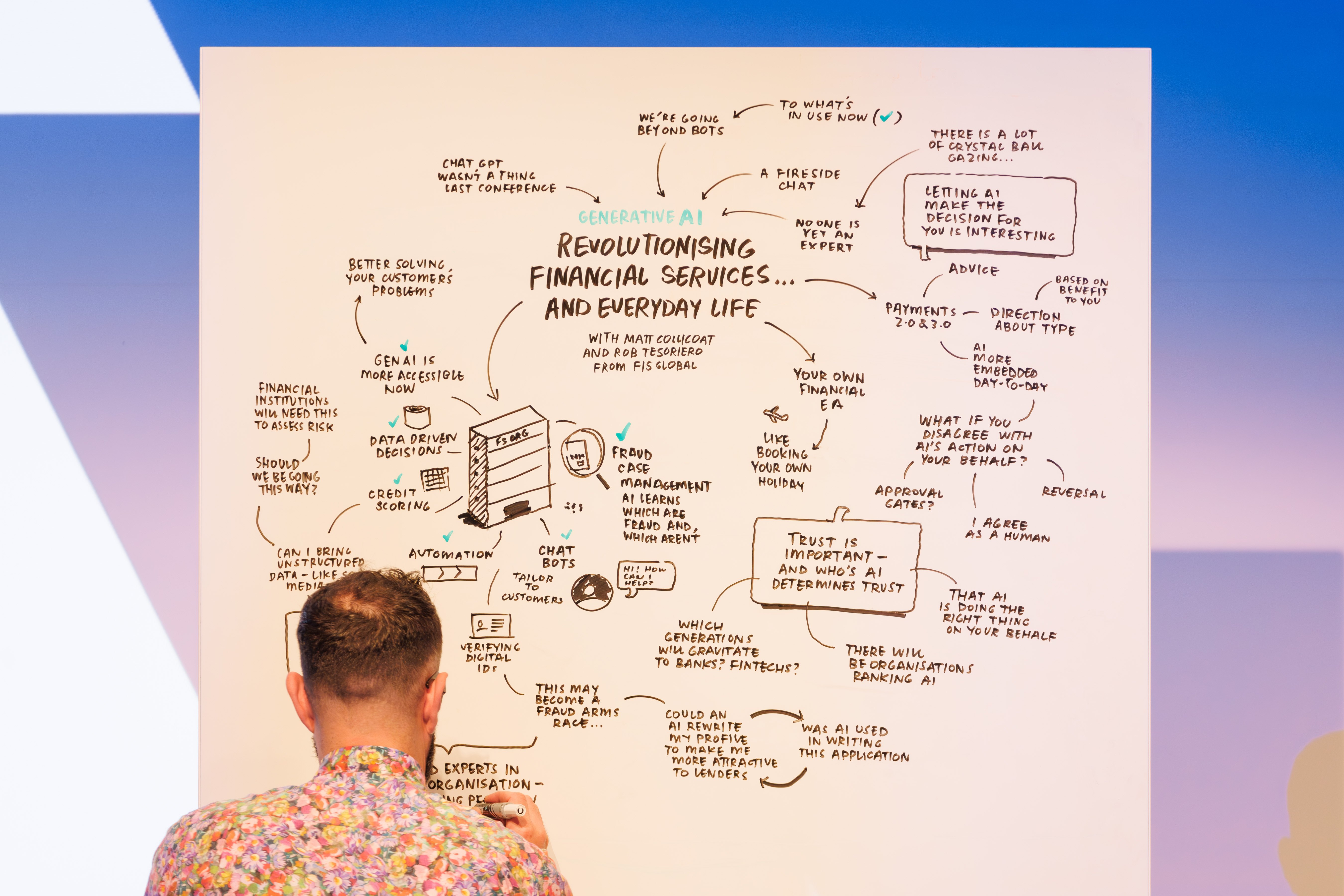

More than 400 delegates joined us at the Aotea Centre in Tāmaki Makaurau Auckland, hearing from 63 speakers and panelists who covered everything from the latest in open banking and regulatory shifts, to the evolving landscape of generative AI, digital identity, and the future of money.

These conversations weren’t just about exploring the trends – they were about finding actionable insights that can help shape the future of payments, both here in Aotearoa and globally. We aimed to create a space where the industry could come together, filter through the noise, and focus on what truly matters for the future.

For me as chief executive of Payments NZ, The Point is more than just an event we host. It’s a moment to step back and reflect on the broader picture and consider our ongoing work as an industry delivering world-class payments for Aotearoa into the future.

Here are a few highlights from The Point 2024 that struck a chord with me.

Thinking with purpose for the long term

The theme of Ki tua – navigating beyond resonated deeply throughout the conference, urging us to think past the day-to-day challenges and look towards the horizon. As we continue to work on next-generation payments, ISO20022 messaging, and open banking, we’re reminded that these initiatives require patient, sustained effort. Success doesn’t come overnight—it's about laying the groundwork now for long-term impact.

Intergenerational thinking was a central focus of The Point 2024, grounded with Matua Rereata Mākiha’s powerful presentation on mātauranga Māori. He highlighted knowledge pathways built across generations and the urgency of rebuilding our connections to the environments and the forces that shape our world.

We want to support the aspirations of those who will be leading the way in the Aotearoa of the future, and our te ao Māori strategy, Tō Mātou Haerenga, reflects this. It’s showing up in our next generation payments work, in our incorporation of Māori data governance into API Centre workstreams, and will be more deeply embedded as a driving force in our strategic thinking over 2025 and beyond.

Raising our view across borders

We’re a country of islands, but we don’t stand alone as a payments ecosystem. As highlighted in Tim Groser’s address and in our panel on economic and trade context for Aotearoa, in an increasingly fractious world we need to place a premium on collaboration and connections across borders.

The call for a Pacific forum on payments highlighted an opportunity to strengthen those relationships. There’s potential to share strengths and partner more closely with Australia and our Pacific neighbours across Te Moana-nui-a-Kiwa – not waiting for government to open the doors but reaching out and making connections ourselves.

As Worldline’s Managing Director APAC Manish Sharma said, single global standards are the utopia, but interoperability is promising and achievable with effort. There’s a real opportunity for us to lead in cross-border collaboration, and initiatives like ISO20022 messaging are key to helping us stay ahead of the curve.

Balancing speed with thoughtful progress

Regulation was a key theme at The Point 2024, and we heard directly from Commerce Commission Chair John Small and a panel discussing the balance of regulation and self-governance in payments. A key discussion point was the importance of aligning incentives across regulators, incumbents and new entrants to support a well-regulated but flexible and competitive market.

As I said at conference, it’s always good when you can agree with the regulator – and I share John Small’s view that we’re poised for greatness as an industry, and that we are at a point to leapfrog ahead.

On the second day of conference Minister for Commerce Hon Andrew Bayly was clear about his expectations for rapid progress in open banking and other areas. Industry is well-placed to get on with it and deliver, but I’m conscious that we need to make progress in a considered way, get it right and bring all across the ecosystem on the journey.

The ‘end of the beginning’ for open banking

The Point took place this year just a week before the second open banking implementation milestone, with the four largest banks in Aotearoa implementing our API Centre’s secure Account Information standard – a point that marks ‘the end of the beginning’ for open banking. It’s here, it’s in the market and it’s gaining momentum.

In the words of open banking and Australian CDR expert Dr Scott Farrell, "rules and tech do nothing by themselves.” Growing open banking means fostering and bringing together a living industry ecosystem, and the track record of the API Centre over five years speaks to its credibility in providing industry leadership.

The Open Banking Showcase demonstrated the potential of account information APIs, from enhancing personal finance and budgeting tools to enabling improved security for person-to-person payments. It goes beyond financial wellbeing to improving social outcomes – Dan Jovevski, WeMoney and Sasha Lockley, Money Sweetspot shared direct examples that really go to the “why” behind our work to promote open banking, and its potential to transform lives.

The foundations are in place and it’s time to grow the industry-led progress. With another two implementation milestones set next year for upgraded standards, continuing our partnering project, and ongoing API standards development work with our members and community contributors, we’re committed to growing the ecosystem and continuing to collaborate with industry.

The growing importance of digital identity in payments

Digital identity has emerged as a pressing topic for payments, and it was a recurring theme at The Point. It was called out at the start of day one as a global trend that is growing in importance and featured across multiple discussions and panels. At Payments NZ, we are actively supporting the development of a digital identity ecosystem, working with key stakeholders to shape its future and help ensure that digital identity is inclusive and serves the needs of all New Zealanders. This is an area where I expect significant progress – watch this space.

Looking ahead

The conversations and insights we shared at The Point 2024 are just the beginning. As we wind down the working year in Aotearoa and head into 2025, I’m energised by the possibilities for our industry.

We’ll be releasing our Payments NZ Year in Review in January 2025 to celebrate this year’s work and achievements and set us up for another big year of delivery. There’s much more to do, and together, we’ll continue to push the boundaries of what’s possible in payments for Aotearoa.

Thank you to everyone who made The Point 2024 such a success. From our speakers to our delegates, to the sponsors and our incredible team at Payments NZ, your contributions made this event unforgettable. Let’s keep the momentum going as we navigate beyond today and into a bright future for payments in Aotearoa.